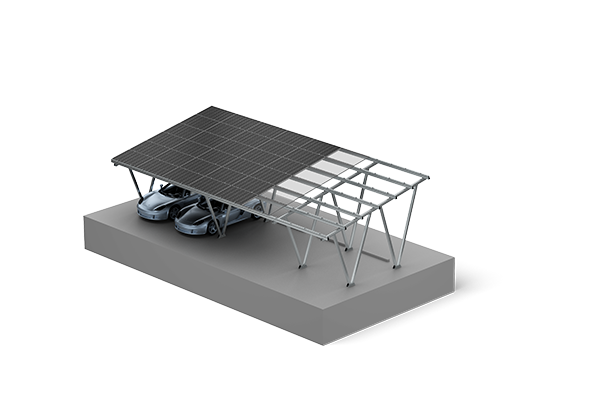

As the demand for renewable energy solutions grows, many homeowners are exploring options for integrating solar power into their properties. One effective solution is the residential solar carport, which not only provides shelter for vehicles but also harnesses solar energy. Understanding the available financing options and incentives can make this investment more accessible and cost-effective.

Financing Options for Solar Carports

Homeowners looking to install a residential solar carport have several financing options available. Traditional bank loans, home equity lines of credit, and specialized solar financing programs offer varying terms and interest rates. Additionally, some local governments and utility companies provide low-interest loans specifically for solar installations. These financing solutions can help homeowners spread the cost of a solar carport over time, making it easier to manage the initial investment.

Tax Credits and Incentives

In addition to financing, numerous tax credits and incentives can significantly reduce the overall cost of a residential solar carport. The federal Investment Tax Credit (ITC) allows homeowners to deduct a percentage of the installation costs from their federal taxes. Many states also offer additional rebates and incentives for solar power installations, further enhancing the financial viability of a residential solar carport. Homeowners should research local and state programs to maximize their benefits.

Conclusion

Investing in a residential solar carport is not only a practical choice for vehicle protection but also a strategic move towards energy independence. With various financing options and substantial tax incentives available, homeowners can find pathways to make solar carports a reality. For robust solutions in solar carport installations, consider the offerings from Antaisolar, known for their strong structural integrity and efficient installation systems.